financing decision applied in capital budgeting process

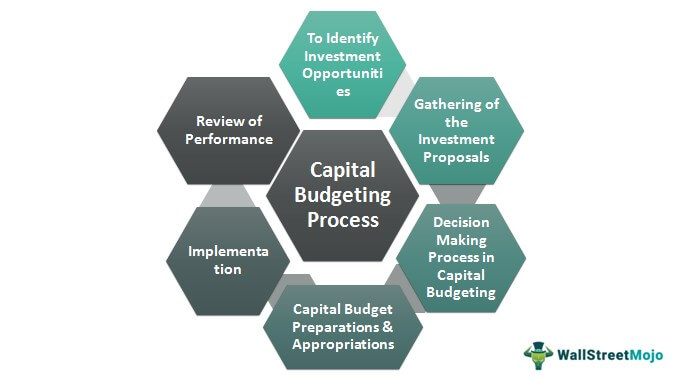

Capital budgeting is the process a business undertakes to evaluate potential major projects or investments. The process for capital decision-making involves five steps.

Capital Budgeting Techniques With An Example Meaning Example

There are two main capital expenditure techniques that abide with the time value of money principle.

. This analysis examines the outgoing cash flow necessary to finance a project the inflow in the shape of income and future outflow. This arises due to risk inflation and opportunity cost. Understanding the different capital budgeting methods can help you understand the decision-making process of companies and investors.

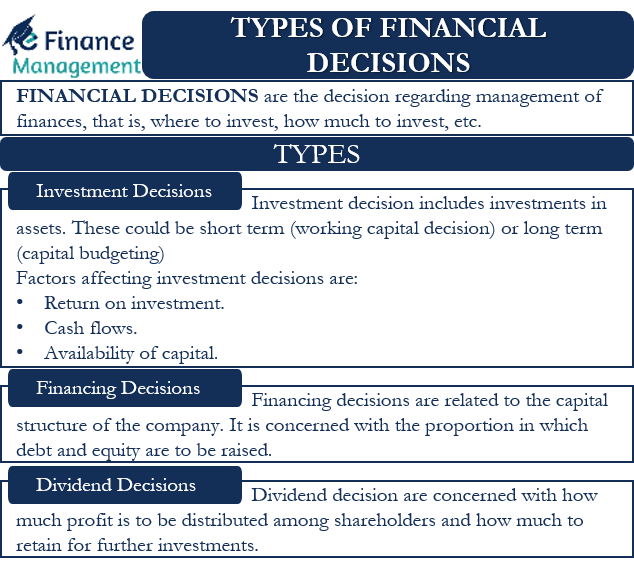

A capital budgeting decision is typically a go or no-go decision on a product service facility or activity of the firm. The financing decision comes from two sources from where the funds can be raised first is from the companys own money such as the share capital retained earnings. These costs are discounted to the present.

A capital budgeting decision is both a financial commitment and an investment. It is the process of deciding whether or not to invest in a particular project as all the investment possibilities may not be rewarding. These stages are 1 Identification of an investment opportunity 2 Development of an initial idea into a specific proposal 3 Selection of a project and 4 Control including postaudit to assess.

Making a capital budgeting decision is one of. For instance a company may choose to value its projects based on the internal rate of return IRR Function The IRR function is categorized under Excel Financial functions. The number that comes out of the DCF analysis is the net present value NPV.

Reducing costs means representing obsolete return on assets. The effect of capital budget decision on financial performance is one of the central questions in both financial management and development. These decisions can be broadly classified as the investment decision the financing decision the dividend decision and the restructuring decision.

Establish baseline criteria for alternatives. Capital budgeting and financial decisions is primarily concerned with the major financial decisions faced by the firm. Capital budgeting is the process of making investment decisions in long term assets.

A capital budgeting decision will require sound estimates of the timing and amount of cash flow for the proposal. TRUE 14 There are no important differences between domestic and international capital budgeting methods. An assessment of the different funding sources for capital expenditures is needed.

The capital structure decision is treated later under the general rubric of firm valuation and it is noted that capital structure can react back on the capital budgeting decision through variation in the weighted average cost of. Though the relevant literature on capital budgeting and business valuation management accounting and investment decisions. Brigham 13 for example capital budgeting is usually taken up early in the context of all-equity financing.

The increase in revenues can be achieved by expansion of operations by adding a new product line. Either increase the revenues or reduce the costs. By taking on a project the business is making a financial commitment but it is also investing in its longer-term.

211 THE CAPITAL BUDGETING PROCESS Capital budgeting or investment appraisal is the planning process used to determine whether an organizations long term investments such as new machinery replacement machinery New plants new products and research and development projects are worth the funding of cash through the firms capitalization. Capital budgeting is an accounting principle companies use to determine which projects to pursue. The acid test for any emerging technology or idea is how it impacts shareholder value.

The crux of capital budgeting is profit maximization. 13 For purposes of international capital budgeting parent cash flows often depend on the form of financing. Whether such investments are judged worthwhile depends on the approach that the company uses to evaluate them.

This encompasses that a 1 now is worth more that 1 in one years time Lucey 2003 p 414. CAPITAL BUDGETING DECISIONS. The process of capital budgeting requires calculating the number of capital expenditures.

In this article we discuss capital budgeting why it is important and the different methods you can use. Thus the manager has to choose a project that gives a rate of return more than the cost financing such a project. Gill Eapen is Managing Director- Predictive Economics Management Consulting at Stout Risius Ross.

It follows a concrete path incorporating and using financial techniques and financial instruments that help in decision making. This effect matters not only for the evaluation and design of investment policy but also for thinking about firm performance. Discounted Cash-Flow is another popular method for capital budgeting.

Capital projects can be independent which means they dont affect the funding of other company projects or mutually exclusive which are tied to other projects financing in some way. Thus we cannot clearly separate cash flows from financing decisions as we can in domestic capital budgeting. An important principle that should be applied in capital budgeting is the time-value of money.

Net Present Value NPV This analytical technique is less reliable for identifying acceptable projects as it ignores the time value of money. Evaluate alternatives using screening and preference decisions. Three keys things to remember about capital budgeting decisions include.

This is where capital budgeting comes in. That is we either accept the business proposal or we reject it. Eapens presentation Using Analytics to Improve the Capital Budgeting Process will be featured at this years CFRI conference on November 14 2016.

Review of Surveys Pinches 1982 applied the Mintzberg Raisinghini and Theoret 1976 four-stage model to capital budgeting. If you go through the capital budgeting process you will understand how much money youll need and if it could financially impact your other ventures. Construction of a new plant or.

The decision rule for this capital budgeting method states a project should be considered acceptable if the difference between its discounted cash inflows and cost is positive. There are two ways to it. IRR will return the Internal Rate of Return for a.

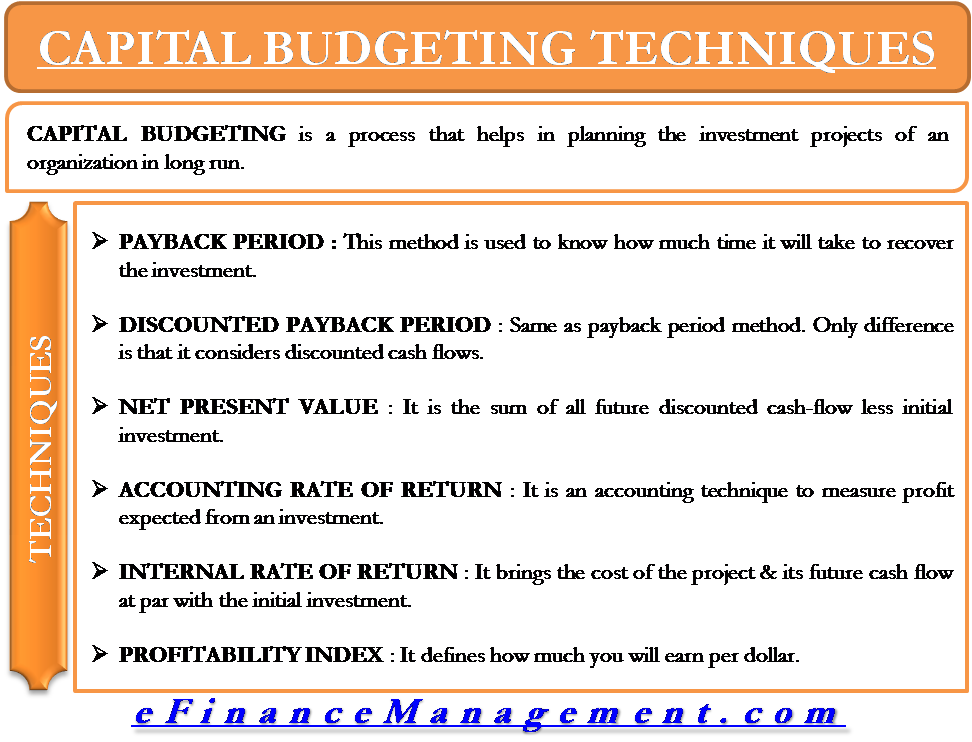

Payback Period Net Present Value Method Internal Rate of Return and Profitability Index are the methods to carry out capital budgeting. Second is from the borrowing funds from the outside the corporate in the form debenture loan bond etc.

Capital Budgeting Process Top 6 Steps In Capital Budgeting Examples

Importance Of Capital Budgeting Budgeting Capital Investment Financial Management

Capital Budgeting Budgeting Process Budgeting Financial Management

Financial Management Capital Budgeting Process Budgeting Process Budgeting Financial Management

Techniques Of Capital Budgeting Budgeting Budgeting Process Investing

Capital Budgeting Techniques Finance Investing Budgeting Accounting And Finance

Capital Budgeting And Capital Accounting Systems Management Guru Budgeting Tools Budgeting Budget Forecasting

Capital Budgeting Decisions Scheduled Via Http Www Tailwindapp Com Utm Source Pinterest Utm Medium Twpin Economics Lessons Budgeting Financial Management

0 Response to "financing decision applied in capital budgeting process"

Post a Comment